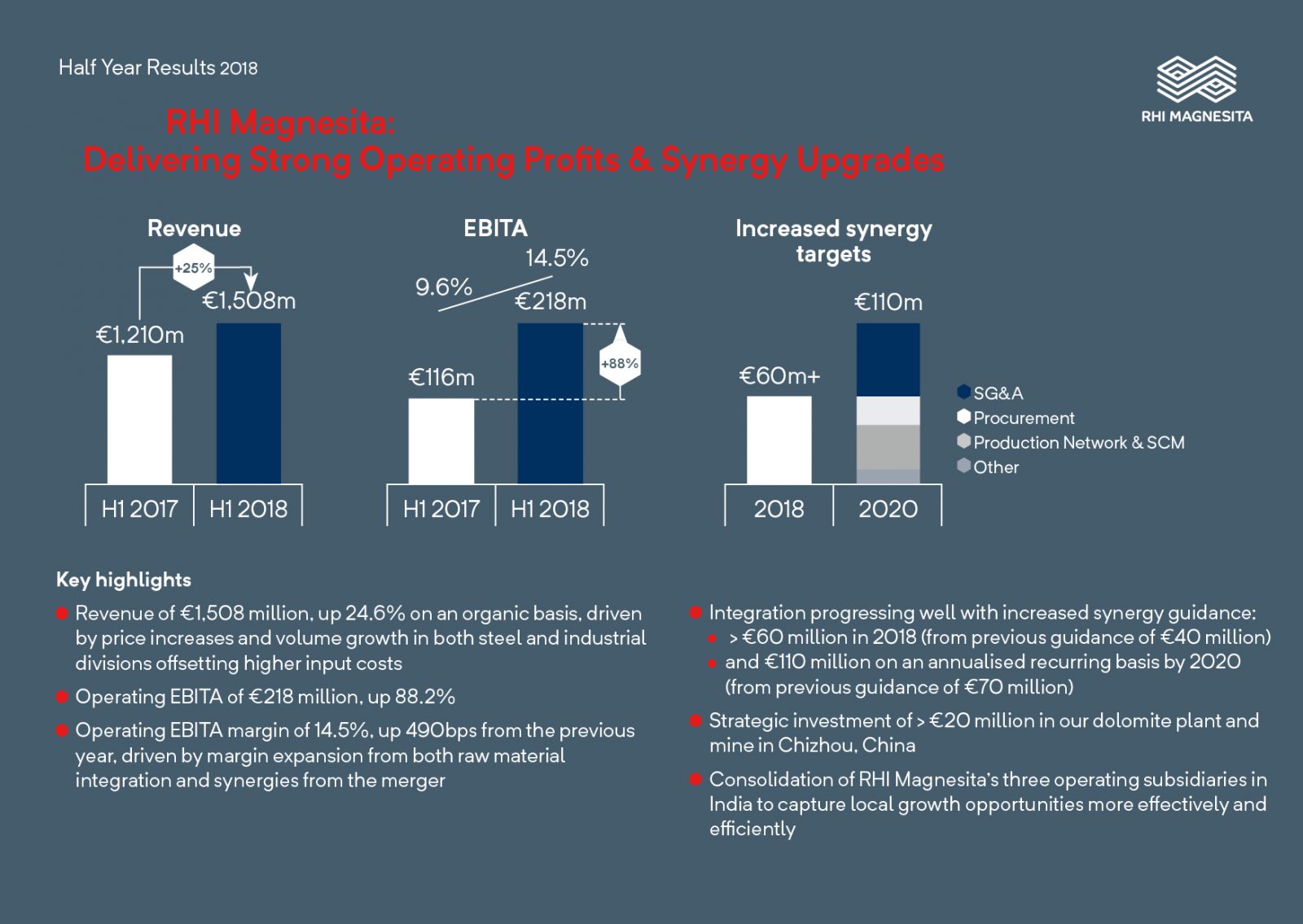

Vienna/London, August 16, 2018 – RHI Magnesita N.V. (LSE: RHIM), the global leading supplier of refractory products, systems and services, today announces its half year results for the six months ended June 30, 2018. RHI Magnesita’s first half results continue to reflect the positive trends seen in the H217, the benefits of our high level of vertical integration and synergies from the combination. Price increases drove revenue development, more than offsetting higher raw material input costs. Revenue for the six months to June 2018 was €1,508 million, 24.6% higher than the comparative period on a constant currency basis (76.4% higher on a reported basis). Adjusted EBITA increased by almost 90% on a constant currency basis, to €218 million, with a 14.5% adjusted EBITA margin.

HIGHLIGHTS:

FINANCIAL SUMMARY:

|

Reported |

Adjustments1 |

|||||

| Adjusted | Pro forma at constant currency | |||||

| Financial Summary | H1 2018 | H1 2017 | H1 2018 | H1 2017 | ||

| €m | €m | €m | €m | Change % | ||

| Revenue | 1,508 | 855 | 1,508 | 1,210 | 24.6% | |

| EBITA | 229 | 64 | 218 | 116 | 88.2% | |

| EBITA margin | 15.2% | 7.5% | 14.5% | 9.6% | +490 bps | |

| Profit before tax | 97 | |||||

| Earnings per share | 1.60 | |||||

| Net debt | 741 | |||||

1 Further detail on the adjustments can be found in Alternative Performance Measures section

Note: This press release is an abbreviated version. The long version including the consolidated interim financial statements as of June 30, 2018 can be found here

Commenting on the results, Chief Executive Officer, Stefan Borgas, said:

“We are delighted to report strong growth of 25% in the first half and profit growth of 88%. We have seen a continuation of the positive trends we saw in the second half of 2017, the benefits of our high level of vertical integration and the synergies from the merger of RHI and Magnesita in Q4 2017. Continued strong demand from our end markets and price increases drove revenue growth, more than offsetting higher raw material input costs. Our integration plans developed ahead of our plan both in terms of speed of capture and total amount.”

“Whilst geopolitical challenges could impact the second half and beyond, we believe our geographically diversified production bases and broad customer profile will insulate the Group to a large extent. Today, we continue to anticipate that full year operating results will accrue the benefits from strong pricing, additional merger synergies and network optimisation.”

“Overall, we have achieved strong first half results and management expectations for the full year operating results remain unchanged. We thank our customers for their support and collaboration in times of tight availability, and our employees for all their ideas, efforts and contributions.”

INTEGRATION AND SYNERGIES

Our integration plan has progressed ahead of our original expectations. The company’s SAP roll-out is advancing as planned and all former Magnesita European production plants have already been converted to the new platform, a sales and supply chain hub has been operational since 1 August in Rotterdam, and Global Business Services, our shared service centre project, goes live at European sites at the end of 2018.

Not only our planned integration actions have materialized faster, but also additional opportunities have been identified which are fully supported by detailed implementation plans. We expect now to deliver savings of at least €60 million in 2018 (from previous guidance of €40 million) and €110 million in 2020 (from previous guidance of €70 million). Approximately, €27 million in synergies were reflected in H1 2018 results.

STEEL DIVISION

Steel production growth year-over-year was robust, at a 4.6%, most notably in Asia and MEA. RHI Magnesita’s deliveries for steel clients have outperformed the respective trends in North America, South America and Europe. Our businesses in India, Central America and Europe were also strong, with deliveries increasing above 10% in the period, and revenue growth of over 30%.

Altogether, revenue for the Steel division was €1,094 million during H1 2018, 29.3% higher than the prior year, reflecting the significant outperformance of our deliveries on top of a very strong underlying market as well as the price increases to compensate for raw material inflation. Sales growth has also been supported by the increasing cross-selling initiatives across both products and geographies.

It still remains too early to gauge the effects of the imposition of trade tariffs, yet the Group believes its diversified production base (in 16 countries across 4 continents) and client base (10,000 customer plants in more than 180 countries) will insulate any significant impact from these developments, as long as industrial output on a global basis remains unaffected.

INDUSTRIAL DIVISION

In the Industrial division, our Glass segment had strong performance, with demand developing for projects in the US and Poland. The Nonferrous metals segment is performing in line with management expectations, new projects are yet to pick-up, despite good progress in new copper projects in Africa and Asia. In EEC (Environment, Energy & Chemicals) we see increasing demand in China, Europe and CIS, with the installation business picking up. The Cement/Lime segment is flat, as result of still low capacity utilization in China and Brazil and some market share losses due to pricing. The Minerals segment has benefitted from raw material price increases and supply shortage caused by the stricter environmental enforcement in China. Revenue growth has flattened out as increased refractory demand has caused the Group to use more minerals internally, and consequently have less raw materials available for external sales.

Revenue for the Industrial division was €413 million during H1 2018, 14.3% higher than the prior year, as lower deliveries to Cement/Lime and sales of Minerals were more than compensated by higher deliveries to Glass clients and price increases across all segments.

CASH FLOW AND WORKING CAPITAL

Operating cash flow amounted to €136 million which was driven by the substantial increase in adjusted EBITA. Cash conversion was held back by the €85 million demand in working capital caused by the 24.6% increase in revenues over pro forma H1 2017 numbers. Nonetheless, working capital intensity improved from 22.2% in December 2017 to 21.4% in June 2018, as strict control on accounts receivables and progress in our payables strategy more than compensated for the inflationary effect in raw material and finished goods inventories.

FINANCIAL CONDITION

Our financial position continues to strengthen, and our deleveraging profile is reinforced by the improving profit, synergies and interest expense reduction.

Net debt reduced from 1.9x adjusted pro forma EBITDA on 31 December 2017 to 1.6x adjusted EBITDA on 30 June 2018, mostly due to the improvement in LTM EBITDA, but also due to the decrease in net debt in the period. Net debt continues to reduce as planned driven by increasing profitability and cash flows, despite the one-off demand on working capital and the mark to market effect on our US dollar liabilities.

In line with the Company’s plan to reposition its capital structure to reflect its improved financial position, on 3 August 2018 the Company successfully raised a new unsecured US$600 million 5-year term loan and multi-currency revolving credit facility with a syndicate of 10 international banks.

The proceeds of the new facility will be used to redeem the entire amount of the outstanding Magnesita Perpetual Bonds and prepay other short-term facilities, which will generate significant interest expense savings. The new Term Loan allows the Company flexibility and liquidity to pursue its long-term strategy.

DIVIDENDS

The Board of Directors believes that a clear and consistent dividend policy is important to shareholders and intends to implement a policy consistent with its status as a U.K. premium-listed, industrial company. This will be communicated later in the year following completion of the Integrated Tender Offer. Consistent with prior years, RHI Magnesita is this year not declaring an interim dividend.

STRATEGIC DEVELOPMENTS

On 26 June 2018, RHI Magnesita announced a strategically important investment in the Chinese market of more than €20 million in its site in Chizhou, Anhui Province in China. The Chizhou site includes an extensive dolomite mine and raw material production as well as facilities for the production of high-quality dolomite-based finished products. Successful trials are already underway in the brick plant in Chizhou where it is planned to start production by the beginning of 2019. The raw dolomite mine is planned to resume operation by the end of 2019. Captive supply of raw materials and local production sites grant a significant logistical competitive advantage for the development of regional markets and the securing of growth opportunities in China and the Asia/Pacific region.

On 1 August 2018, RHI Magnesita announced the proposed merger of its three Indian subsidiaries. The merger is designed to optimally position RHI Magnesita’s operations in the strategically important Indian market to capture growth opportunities more effectively and efficiently, by combining the strengths and competencies of each company. This merger is part of RHI Magnesita’s strategic pillar “markets” which focuses on building a global presence with strong local organizations and solid market positions. India became the third largest steel producer in the world after a decade of solid growth and an ambitious government program aims to reach 300m tons of steel production by 2030, triple the output of 2016. With one strong and integrated local organization, the industry’s most comprehensive product portfolio and proven supply and sales capabilities RHI Magnesita India will be optimally positioned to leverage the positive local market developments.

OUTLOOK

The strong trading performance reported in our Q1 2018 update has continued and our business developed positively in H1 2018, supported by continued strong demand from our end markets, raw material integrations and the accrual of synergies.

Currency headwinds have reduced slightly since the first quarter, with the US dollar strengthening against the Euro and the Chinese Yuan. The Group’s revenue and profit growth rates achieved in H1 2018 were higher than we anticipate for the full year, as the H2 2017 results already reflected improved market conditions and some effect on revenues and margins from the pass-through of raw material input inflation. Management believes raw material prices will remain at current elevated levels during the second half.

Overall, management expectations for full year operating results remain unchanged.

About RHI Magnesita

RHI Magnesita is the global leading supplier of high-grade refractory products, systems and solutions which are indispensable for industrial high-temperature processes exceeding 1,200°C in a wide range of industries, including steel, cement, non-ferrous metals and glass. With a vertically integrated value chain, from raw materials to refractory products and full performance-based solutions, RHI Magnesita serves more than 10,000 customers in nearly all countries around the world. The Company has broad geographic diversification with more than 14,000 employees in 35 main production sites and more than 70 sales offices. RHI Magnesita intends to use its global leadership position in terms of revenue, greater scale, complementary product portfolio and diversified geographic presence around the world to target opportunistically those countries and regions benefitting from more dynamic economic growth prospects.

Its shares have a premium listing on the London Stock Exchange (symbol: RHIM) and are a constituent of the FTSE 250 index. For more information please visit: www.rhimagnesita.com

Enquiries:

RHI Magnesita N.V.

Stefan Rathausky, Senior VP Corporate Communications

Tel +43 50213-6059

E-Mail: stefan.rathausky@rhimagnesita.com