- About

- Solutions

- Governance

- Investors

- Sustainability

- Sustainability

- Newsroom

- Jobs

Global efforts towards decarbonisation have recently gained support from various industries. One of the most feasible paths to reduce carbon emissions is by implementing hydrogen as a fuel and/or a process gas. The refractory industry plays an important role in this initiative, being integral in many different applications and production processes. The most significant impact is likely to be seen in the steel industry, where anticipated changes in current production technologies could affect both operations and the performance of refractory linings. Different wear mechanisms are expected in direct reduced iron units due to the increased hydrogen content and additionally the electric arc furnace will also experience changes due to the increased use of sponge iron over scrap.

Decarbonisation presents challenges to most of the high temperature industries. Multiple companies have planned different initiatives, and hydrogen is undoubtedly a key pillar towards limiting carbon emissions. This is especially crucial in steelmaking, as this industry alone contributes up to 9% of global greenhouse gas emissions [1]. Therefore, efforts are currently underway to bring these figures down, including efficiency optimisation and adapting current production processes. For example, alternatives include investing in new direct reduced iron (DRI) units to target emission reductions when compared to the blast furnace (BF) route. Electric arc furnaces (EAFs) are well-established technologies that nowadays are predominantly charged with only scrap. However, the increased hydrogen atmospheres in DRI units may not only impact the lining performance, but in addition the higher use of DRI in the EAF can lead to changes related to the electrical and chemical energy demands, hot heel, and slag operation, which will directly affect the refractory lining selection.

In recent years, the world has seen diverse initiatives promoting emission and energy consumption reductions. Many countries and companies worldwide are striving to achieve shared energy and climate goals within the next decade, with the main industry sectors considering various alternatives, such as continuous improvement, process enhancements, and carbon capture, among other possibilities. The use of hydrogen as a fuel and a process gas is one of the most important trends for reducing CO2 emissions in a relatively short time.

Hydrogen can be produced in various ways, resulting in a colour-based classification system, typically divided into main colours and others (Table I). The main colours of hydrogen production are: (1) Green, (2) Grey/brown/black, and (3) Blue. The first group highlights hydrogen sources such as biomass, biomethane, and all alternative routes of water electrolysis using renewable energy (e.g., solar, wind, and hydroelectric) that avoid using or generating any greenhouse gases. The second group includes all processes based on hydrocarbons, which generate CO2 that is afterwards released into the atmosphere. The third group encompasses the same processes as the second but includes carbon capture and storage at the end of the production chain. From these main groups, additional colours such as pink, turquoise, and brown are derived, representing other possible routes to produce hydrogen. Each of these methods impacts emissions and energy consumption in different ways [3].

Recent global statistics show that hydrogen production has been increasing in the last years. For example, in 2022, total hydrogen production was about 95 million tonnes, 3% higher than the previous year. Currently, most production is performed using fossil fuels, as the majority of low-emission hydrogen production processes are still projects under development or at the feasibility study stage. In total, these low-emission plants accounted for only 0.7% of overall worldwide production in 2022. Nevertheless, a significant increase of up to 30% is already planned by 2030 [4]. In most industries, once hydrogen has been produced, it can be used either as fuel or a process gas. Different impacts on the refractory lining are expected, as there is a main difference between both cases, which relates to the direct contact of refractory materials with hydrogen gas.

One of the main planned developments in the iron and steelmaking industry is the increased use of hydrogen in DRI units, upstream of the EAF or electric smelting furnace/ BOF routes (Figure 1). Although current DRI technologies already use a gas mixture based on H2 and CO, efforts are underway to develop an even cleaner process where the use of carbon can be reduced and substituted by up to 100% hydrogen. Wear mechanisms in the refractory linings may change in these DRI units, as well as in the subsequent EAF, where part of the scrap may be substituted by DRI.

For over 70 years, various DRI technologies have been developed around the globe as an alternative to the BF route. With these technologies, the reduction of oxidised iron ore occurs in a gaseous environment using a mixture of reducing gases, usually based on H2 and/or CO. These processes achieve a very high level of metallisation of the iron ore, which is then used in steelmaking shops.

Global DRI production was 127.36 million tonnes in 2022 [6]. This represents about 7% of the steel production during that year, which totalled 1885 million tonnes worldwide [7]. Although the impact of DRI on the industry is currently still low, it is expected that the installed capacity will increase significantly in the coming years due to recent net-zero emission initiatives.

The state-of-the-art DRI process typically uses a H2/CO gas ratio of about 1.6 on average, operating at temperatures around 900 °C. The partial pressures can vary depending on the technology, and in some cases this ratio may even rise to nearly 3.9 [8]. This is due to the use of natural gas as the main feedstock for the reformation stage, to prepare the gas mixture used as a reductant. Although current DRI technologies still produce some CO2 in their off-gases, these processes potentially reduce CO2 emissions by 38–61% compared to the standard BF route [9].

Decarbonising the steel industry may require several different actions from most of the important players in this market segment. For example, in the ironmaking stage carbon capture, BF enhancements, and/or the implementation of DRI units are feasible solutions to reduce emissions effectively.

The main DRI original equipment manufacturers (OEMs) are also developing new processes that are targeting 100% hydrogen-based units. These emerging technologies may require updated refractory concepts, as changes to the process parameters, which in most cases affect the gas composition, could lead to more aggressive wear mechanisms in the refractory lining, primarily caused by the enriched hydrogen atmosphere.

Only a few investigations have been conducted to analyse the behaviour of different refractory materials in pure hydrogen atmospheres [10] and the different methods and types of furnaces used led to various results that in some cases were contradictory. However, overall it has been confirmed that one of the oxides contained in refractory materials, namely SiO2, reacts very easily with H2. The resulting silica loss is a phenomenon where hydrogen reacts with the refractory material, reducing the brick or castable, causing a detrimental effect on the properties of the refractory lining. This reaction is primarily driven by temperature and pressure, occurring more rapidly at higher temperatures. In contrast, the opposite behaviour is observed for pressure, where higher pressures somehow slow down the same reaction [10,11].

Thermodynamic modelling can be used to calculate the weight loss of SiO2 and SiO2-containing refractory raw materials (e.g., mullite) due to the reduction of SiO2 by pure hydrogen at increasing temperatures (Table II). This reaction accelerates in cases where either the SiO2 content is higher, the temperature is higher, or the partial pressure is lower. These observations also align with studies of SiO2-containing refractory brick samples exposed to the same atmospheres and temperature conditions [12].

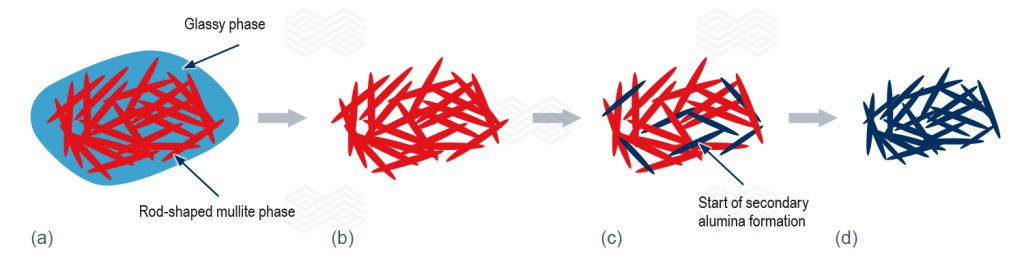

One of the main challenges that refractory producers and OEMs are now facing is understanding the possible impacts of changes in operating conditions that increase the hydrogen content. However, recent laboratory studies provided an insight into the reduction mechanism of silica containing refractories [11]: First, the glassy phase, prone to react with hydrogen, forms SiO gas; second, SiO2 is reduced in the mullite phase; and third, secondary alumina forms over time when an Al2O3/SiO2 ratio higher than 2.6 is reached (Figure 2).

Figure 2. Reduction mechanism of a silica-containing refractory matrix in a hydrogen atmosphere. (a) typical silica-containing refractory matrix, (b) preferential reduction of glassy phase due to the formation of SiO gas, (c) SiO2 loss from the mullite phase resulting in the formation of secondary alumina, and (d) complete replacement of the mullite phase by secondary alumina.

The conclusions from these studies were substantiated by postmortem analyses performed on refractory bricks taken from state-of-the-art DRI units after years in operation. A representative microstructure of a sample recovered from the reduction zone showed that the glassy phase had been attacked by the reducing gas mix on the outer most part of the hot face (Figure 3 delineated by red dots), while the mullite network remained intact and was not affected by reduction (Figure 3 highlighted by red arrows).

In general, refractory linings in DRI shaft furnaces withstand current process conditions for several years. However, the anticipated increase in hydrogen content will necessitate refractory lining enhancements, such as increased Al2O3 contents, which reduces SiO2 weight loss but also impacts other important factors, such as the heat transfer coefficient, overall refractory lining weight, and its costs. Many investigations are currently underway to test various types of refractory materials against different hydrogen-reducing atmospheres at different temperatures and partial pressures [11]. These activities can be performed at RHI Magnesita’s Technology Center Leoben (Austria), supporting decision makers by providing specific insights in this regard. So far, preliminary results have shown that the reduction wear mechanism is expected to change slightly compared to current technologies and may impact widely used refractory products. Furthermore, these investigations will continue, as refractory producers are committed to supporting major OEMs understand the potential effects on refractory products and their properties due to long-term operation with new process parameters, while maintaining cost competitiveness in any future greenfield projects.

RHI Magnesita offers worldwide production capacity, including customisable refractory linings tailored to each customer’s specific needs. For DRI applications, a wide variety of refractory bricks and castables are available for the different equipment within these units. A combination of well-known brands, such as MAXIAL, RESISTAL, DURITAL, COMPRIT, DIDURIT, and LEGRIT, positions RHI Magnesita as a reliable partner for this growing application.

Once the high-grade DRI has been produced, it is delivered to the steel shop in either pellet or briquette form, cold or hot, and charged into the EAF through its roof. In general, use of DRI in the EAF offers advantages, such as controlling residual elements like Cu or Mo, and tends to reduce nitrogen levels in crude steel. This enables the production of high-quality steel grades, which are currently produced mainly through the BF-BOF route. However, its use presents many challenges for the furnace operation, including higher electrical energy consumption, higher slag volumes, and longer tap-to-tap times compared to a standard EAF charged with 100% scrap. The main reason for these changes is related to the DRI chemical and physical properties. Two of the most important parameters affecting the furnace operation are the degree of metallisation, defined as the level of metallic iron in the pellet, and the gangue content, which is mainly formed from acidic oxides such as SiO2 and Al2O3 (Table III).

The expected variances in EAF process conditions may directly affect the refractory consumption in the steel shop. For example, an increased SiO2 content in the DRI would require more lime to reach the optimal basicity, while also necessitating more electrical energy to melt the additional slag formers. Additional studies have shown that if the EAF charging mix contains more than 20% DRI, there may be a negative impact on productivity, refractory lifetime, power-on time, consumables, and energy consumption [14]. Furthermore, the need for high-performance refractory lining grades and maintenance mixes may also increase [15].

Usually, for cases of increased DRI charge ratios in the EAF, some basic requirements must be fulfilled:

To support customers in these and other areas, RHI Magnesita offers a range of refractory solutions for the EAF (Table IV).

Currently, the future of the steel industry is very dynamic, with activities focused on diverse decarbonisation initiatives to tackle carbon emission reductions from various perspectives. From the ironmaking stages all the way down to the cast houses, key stakeholders are working on developing cleaner processes to achieve global environmental goals. The use of hydrogen offers potential solutions to this issue, whether as a fuel or a process gas. It is very likely that refractory linings will need to be reviewed, especially when hydrogen is used as a process gas, since this significant change in the operational parameters may impact refractory performance. Therefore, RHI Magnesita is conducting multiple analyses to simulate the possible effects of various hydrogen-reducing atmospheres at different temperatures, with the target of designing tailored refractory solutions for hydrogen-enriched DRI units. Furthermore, an increased use of DRI in EAFs is also expected, and while variations in operation are anticipated, there is significant potential for improvement by selecting the right refractory lining concept. As a global leader in this field, RHI Magnesita is committed to supporting customers with state-of-the-art refractory solutions, specialised process know-how, and a network of worldwide production sites and technology centres.

[1] Kim, J., Sovacool, B.K., Bazilian, M., Griffiths, S., Lee, J., Yang, M. and Lee, J. Decarbonizing the Iron and Steel Industry: A Systematic Review of Sociotechnical Systems, Technological Innovations, and Policy Options. Energy Research & Social Science. 2022, 89, 102565.

[2] Pollet, B.G. Les enjeux des minéraux critiques et stratégiques dans la filière hydrogène. Presented at Journée bretonne Hydrogène R&D – Industries – formations, Saint Malo, France, 29 May, 2024.

[3] Broadleaf Capital International Pty Ltd., Australia. The Colour of Hydrogen. August 2021. https://www.broadleaf.com.au/resource-material/the-colour-of-hydrogen/

[4] International Energy Agency. Global Hydrogen Review 2023. December 2023. France. https://iea.blob.core.windows.net/assets/ecdfc3bb-d212-4a4c-9ff7-6ce5b1e19cef/GlobalHydrogenReview2023.pdf

[5] Kirschen, M., Dieguez, U., Gruber, M., Schmidt, V. and Trummer, B. Energy Savings and Additional Benefits of Inert Gas Stirring in Electric Arc Furnaces with a Focus on Green Steelmaking. Bulletin. 2023, 18–25.

[6] Midrex Technologies, Inc., Charlotte, USA. 2022 World Direct Reduction Statistics. September 2023.

[7] World Steel Association, Brussels, Belgium. 2023 World Steel in Figures. 2023.

[8] Millner, R., Rothberger, J., Rammer, B., Boehm, C., Sterrer, W., Ofner, H. and Chevrier, V. MIDREX H2 – The Road to CO2-Free Direct Reduction. Proceedings of AISTech 2021, Nashville, USA, June 29–July 1, 2021.

[9] Ling, J., Yang, H., Tian, G., Cheng, J., Wang, X. and Yu, X. Direct Reduction of Iron to Facilitate Net Zero Emissions in the Steel Industry: A Review of Research Progress at Different Scales. Journal of Cleaner Production. 2024, 441, February.

[10] Ribeiro Gomes, M., Leber, T., Tillmann, T., Kenn, D., Gavagnin, D., Tonnesen, T. and Gonzalez-Julian, J. Towards H2 Implementation in the Iron and Steelmaking Industry: State of the Art, Requirements, and Challenges for Refractory Materials. Journal of the European Ceramic Society. 2024, 44(3), 1307–1334.

[11] Ribeiro Gomes, M., Ducastel, A., Konrad, L., Janssen, T. and Ospino, E.E. Hydrogen-Resistant Refractories for Direct Reduced Iron Production. Proceedings of METEC and 6th ESTAD, Düsseldorf, Germany, June 12–16, 2023.

[12] Ospino, E.E., Hebenstreit, G., Postrach, S., Gavagnin, D. and Janssen, T. Challenges for the Refractory Industry to Support the Foreseen Large-Scale Transition to DRI Shaft Kilns. Proceedings of AISTech 2023, Detroit, USA, May 8–11, 2023.

[13] Gavagnin, D., Kyrilis, E., Estrada Ospino, E.J., Spreij, M. and Postrach, S. Refractory Lining Challenges in Transitioning from Established to Hydrogen-Ready Operations in DRI Shaft Furnace Technologies. La Metallurgia Italiana – International Journal of the Italian Association for Metallurgy. 2024, November/December (in press).

[14] Hanna, A. and Zettl, K. Modern Electric Arc Furnace Processes and Their Requirements for Improved Lining Concepts. RHI Bulletin. 2015 1, 17–24.

[15] Kirowitz, J., Schnalzger, M., Janssen, T., Kirschen, M., Spanring, A., Moulin-Silva, W., Ratz, A., Kollmann, T. and Wucher, J. Electric Melting Furnaces for Green Steel Transformation of Integrated Steel Plants – Requirements, Challenges, and Solutions from a Refractory Perspective. Procedures of the 9th European Oxygen Steelmaking Conference. Aachen, Germany, Oct. 17–22, 2022.

[16] Servos, K., Madey, M., Hanna, A., Hochegger, M. and Debisarran, R. Installation and Practical Experience with Preassembled EAF Slag Door Blocks at Arcelor Mittal Point Lisas. RHI Bulletin. 2015, 1, 25–28.

[17] Kirschen, M., Dieguez, U., Gruber, M., Schmidt, V. and Trummer, B. Energy Savings and Additional Benefits of Inert Gas Stirring in Electric Arc Furnaces with a Focus on Green Steelmaking. Bulletin. 2023, 18–25.

[18] Zettl, K., Zottler, P., Bachmayer, J. and Kirschen, M. State of the Art Tapping Solutions for Bottom Tapping EAFs. Berg- und Hüttenmännische Monatshefte. 2013, 158, 13–16.

[19] Kirowitz, J., Lanzenberger, R., Petritz, B., Rechberger, L. and Dieguez, U. Sustainable Refractory Solutions—New Gunning Mixes Containing Circular Material. Bulletin. 2023, 26–32.

[20] Souza, P., Freitas, C., Arth, G., Penido, G., Zettl, K., Bolognani, J., Lamare, C., Lammer, G., Moser, G. and Hoffert, A. Next Level of Digital Refractory Contracts. Bulletin. 2022, 52–59.